Most of you always panic about managing money. Well, there’s a simple strategy that will change your financial life and you don’t need to be Robert Kiyosaki or Donald Trump to understand it.

Can you simpy make a guess how bad our education is when it comes to money? We’re taught laughable misinformation about money and then we go out into the working world to dedicate our entire career to earning it.

Robert Kiyosaki was right in the book Rich Dad Poor Dad; “The love of money is the root of all evil. The lack of money is the root of all evil.”

Be honest and reply to your heart “Why do you work and for whom?”. The only answer is “..for money”. If you’re working for money and you don’t understand how it works, it’s going to hurt you in so many unexpected ways. You have to move away from the mindset that “saving is good.”

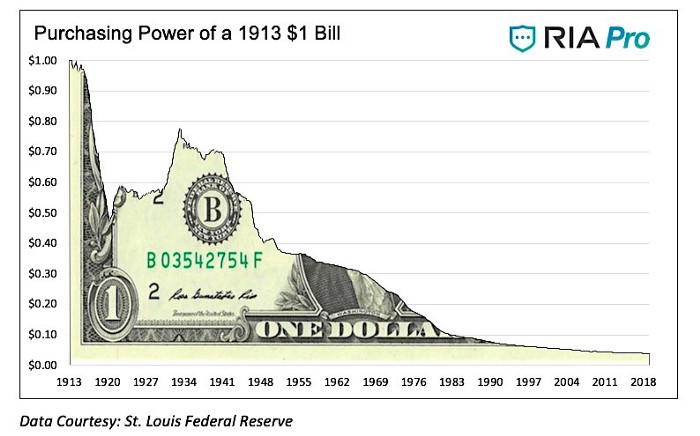

This image perfectly describes why saving money will destroy you financially. Every minute you save money is another minute inflation is eating away at you, and the time and effort you spent to earn it. Why work really hard and then have your money be devalued? It doesn’t make any sense. It’s madness.

There is a much simpler way to think and realize about your money that will set you up financially and allow you to stress less and work less if you choose . Here are the 4 tips by Tim Denning you shouldn’t miss. 4 min more read and you’ll have 40 more years to live in peace. Here you go!

- How to Have Money Work for You, Not Against You

There is a solution to this problem of saving money and you don’t have to be an investment guru like Warren Buffett to understand it.

You can prevent yourself from being financially destroyed by money when you change your approach to this:

It’s *not* about how much money you make. It’s *not* about how much money you save. It’s about you how much you invest.

Investing your money simply means putting your money to work (for you).

Even if you invest your money it still won’t help you. Investing your money is not enough because you need to understand one more idea: diversification.

2. You will still be destroyed financially if you don’t take this extra step

The hardest part to understand is how much money to place into each asset class. The solution to this problem is different for everybody. How much money you invest in each asset class depends on your financial situation and your age.

If you’re broke or have lots of credit card debt then you’re normally going to focus on wiping that out first before worrying about investing. If you have no debt but only have less than $10,000 then you’re probably going to want to be more cautious in case you need access to that money. If you have $100K or more to invest then you might want to be a little more aggressive.

If you’re a millennial like me then you may want to go a little more aggressive into stocks because you’ll have time to ride out any recessions.

The way to save yourself financially is to learn about where you should invest your money and how much cash to allocate to each asset class.

In really simple terms, you want to learn enough about money that you can successfully put a percentage value next to each asset class. Here is a mock example:

Gold: 5%

Real Estate: 30%

Digital Currency: 5%

Bonds: 20%

Stocks: 40%

Learn about each of these asset classes and then allocate your money accordingly.

3.The next challenge

Each of these asset classes has subcategories.

For example, there are treasury bonds and junk bonds, and there are small-cap, large-cap, and tech stocks to choose from. This is the next level of detail and it requires further learning to understand what makes sense for you.

An easy solution is to buy index funds for stocks, bonds, and even real estate, so you get exposure to each. The cheapest index fund I’ve found is Vanguard and they are widely recommended. They obviously have many different products so it requires a bit of research before deciding.

4. The state of the economy

There is one last consideration you need to think about when you invest your money and diversify across different assets based on your age: where are we at in the economic cycle?

In other words, is the stock market and economy in a period of extreme growth, very little growth, or recession? As I write this, we’re in a recession.

Thinking about the state of the markets is important because it shapes what assets you buy. Right now we are living in an upside-down global economy with negative oil prices, massive amounts of money printing, negative-yielding bonds, and expected inflation that is higher than normal.

So in a recession, you might like that stocks are cheap because you get a discount. You might want to own fewer bonds because some of them pay you nothing. You might want to look at inflation resistant assets because times are uncertain.

Remarks

Saving money will destroy you, as we’ve seen with the devaluing of the dollar over time because of inflation.

Making money is pointless if you don’t keep any of it, and end up going mad and spending it like every day is Christmas Eve. The strategy that makes sense when it comes to money is to invest it so your money is working for you, not against you because of inflation.

Put your money into assets that make you more money or assets that protect you in times of uncertainty due to a recession.

Then, when you think about investing, consider your age, financial circumstances, how you’re going to diversify across different asset classes, and the financial season the economy is in.

If you make money and invest — instead of saving — you will have the money to stress less, do work you enjoy, and help others.