Today, Globally, 69 percent of adults – 3.8 billion people – now have an account at a bank or mobile money provider, a crucial step in escaping poverty. With the rise in standards of living among majority of the urban population, people choose to acquire banking service at their finger tips. Customers are in need of an ideal, personalized, interactive customer experience provider which is stable with unified experience serving quality. People want to connect with their bank in their own terms, and their requirements can be fulfilled by services like Omnichannel banking.

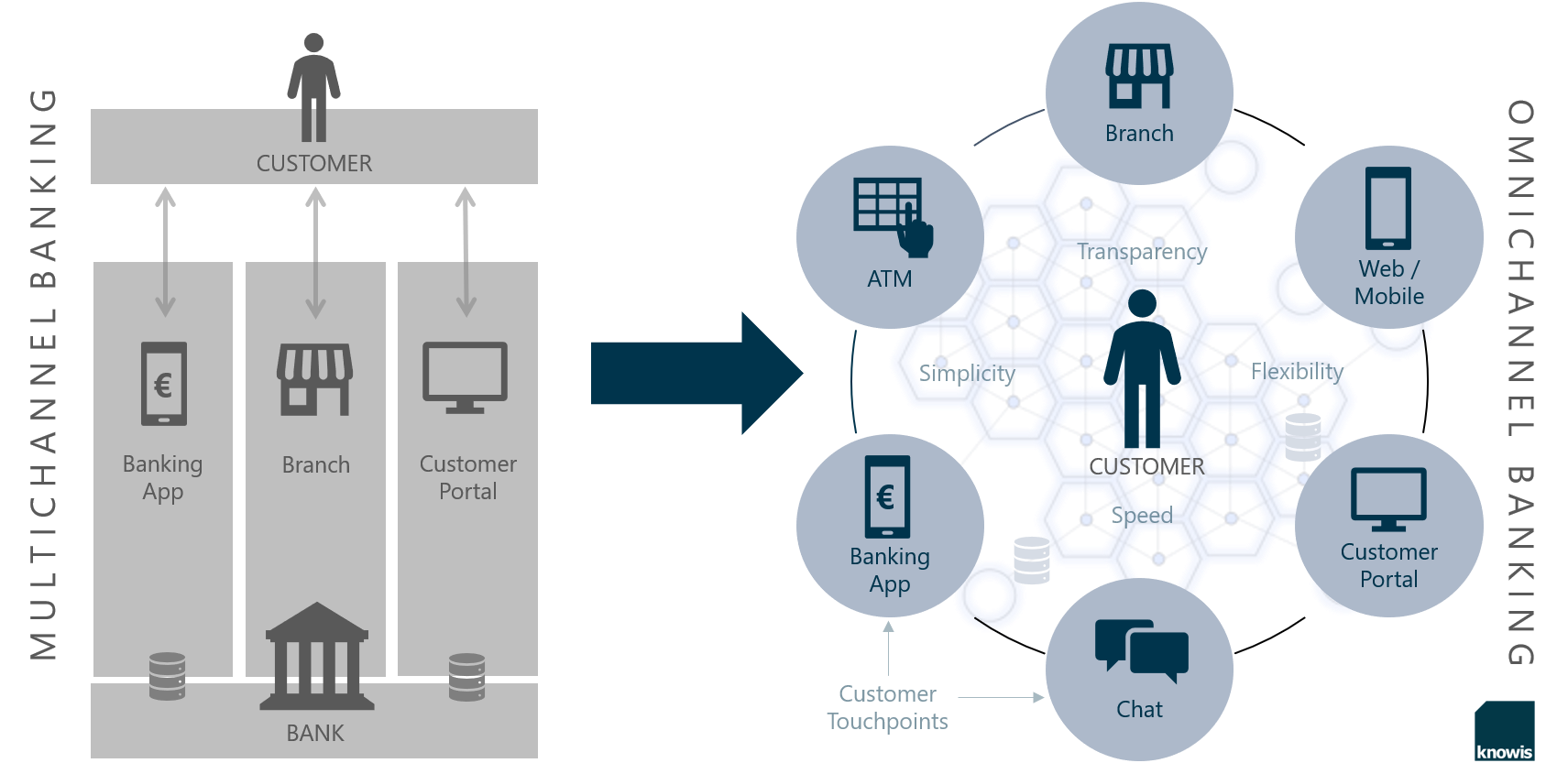

Omnichannel is about making the same set of services available to customers across all the channels, both digital and offline.

Konstantin Didur

The meaning of omnichannel banking

Clients can perform the same banking operations, whether they use a website, a mobile app, a call center, a bank’s branch, or any other available channels.

But there’s more to it.

True omnichannel banking platform also allows real-time data synchronization between different channels. For instance, customers can start the onboarding process with one channel and finish it with another without the need to provide the same data over and over again.

We’ll have a look at a detailed example later in the post.

Additionally, omnichannel banking has many implications for back-office operations. Such platform can improve marketing performance, simplify onboarding processes, boost customer retention rates, and much more.

Why use omnichannel in retail banking?

To put this simple, Omnichannel Banking puts the Customer in the Spotlight and the advantages for the customer are obvious:

Transparency

- The customer can view, complete or correct their data as per their convenience.

- All the information that has accumulated online or offline can be discussed on-site with the bank representatives.

Simplicity

- The customer has to provide information only once, after which it is available for each transaction albeit security features urge the customer to make necessary verifications on each attempt to transaction.

- Required documents and other attachments can be uploaded from the home PC, identification checks can be done online.

- Informing themselves about new products, customers can use the data of their history and thus obtain a tailor-made offer that considers all factors.

Flexibility

- The customer can use all channels – online and offline, 24/7.

- The opening hours of the branch become less important.

- All information is available, regardless of the channel used.

Speed

- All in all, this leads to significantly shorter throughput and processing times. Consultations with the customer and manual internal coordination processes are minimized.

- Status information updates can be requested in real time or sent via push notification.

However, it is not only the customer who benefits. The bank also saves a considerable amount of administrative work, because now the information which previously had to be researched in advance is available at the push of a button. Consequently, advisors can, for instance, provide information about the processing status of a loan application at any time, without long approval cycles, and thus improve the service. The customer comes back into focus, the employee takes more care of value-adding activities. Alternatively, the customer can autonomously check the status in the online customer portal or automatically receive notifications of a status change, which additionally relieves the bank consultant. This form of customer service is an important tool for enhancing customer loyalty in times of significant competitive pressure.

Challenges

Great good comes with tough challenges. You must be wondering, why are banks so reluctant to use it if Omnichannel banking is such a bliss?

A shift from a legacy software architecture to an omnichannel digital ecosystem is an extremely challenging process. It takes all of the following:

- A sizable investment into a new platform. Banks can break down this big transition into meaningful stages albeit, omnichannel digital platform is going to be costly.

- A complete technological redesign. Implementing an omnichannel banking platform is a real technological challenge.

- Truly tectonic shifts in corporate culture. Banks can use the FIX framework of digital transformation to manage this change.

Top 5 Most Popular Omnichannel Banking Solution Providers

This list is suggested by The Forrester Wave™: Omnichannel Banking Solutions, Q3 2015.

1. Backbase Omnichannel Digital banking solution

2. Infosys Omnichannel Banking Solution

3. Sopra – Omnichannel Banking Software

4. Misys – Financial Software Solutions

5. SAP – Omnichannel Banking Solution

Lastly,

The portfolios and fee schedules of banks shouldn’t be the sole critical factors deciding which institutions will continue to have an influx of customers in the future, and thus have a long-term existence. Fueled, among other things, by new competitors from the fintech sector, the customer experience is becoming one of the decisive determinants in the increasingly tense financial market. Else the banking sectors will end up being the next NOKIA.

That is exactly why traditional banks and financial services providers have to catch up on enhancing the digital customer experience – starting at the very base. Because only a database that connects all touchpoints enables modern omnichannel banking and thus a sustainable customer journey that forms a long-term bond between the bank and the customer.